Payroll calculation online

The payroll software solution in Dayforce delivers real-time global visibility efficiency and compliance and eliminates redundant manual processes. You are considered to have been employed by your employer for at least 30 calendar days if your employer had you on its payroll for the 30 calendar days immediately prior to the day your leave would begin.

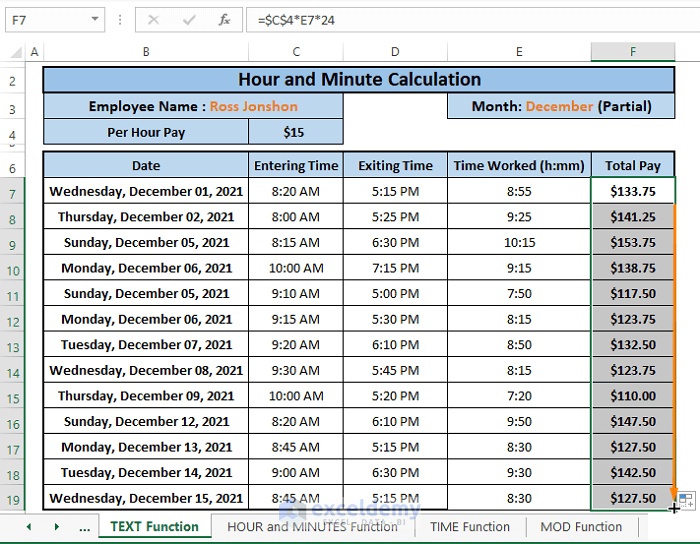

How To Calculate Hours And Minutes For Payroll Excel 7 Easy Ways

SurePayroll is a Small Business Payroll Company providing Easy Online Payroll Services such as Payroll Tax Services Accounting Services and 401k Plans.

. Reads part period parameters. Accurate tax liability calculation. The first step to correct payroll calculation is to establish a working system for time tracking.

We offer free payroll setup to help you get your account set up and can enter all payroll history for you. It is a smart business decision to invest in an online check stub maker that allows you the convenience to create check stubs that are reliable and. Embrace diverse salary structures.

We use Celery as our payroll and HRM solution because we have a 100 guarantee that the calculation is accurate through the software. Mileage calculation provided by the Australia Taxation Office - 78 cents per kilometre from 1 July 2022 for the 2022-2023 income year. A good payroll management software puts an end to increased complexities of payroll processing and offers following benefits.

Tax Calculation Filing. This can make life easier for you when calculating it for different employees. Our enhanced employer online services are the easiest and most convenient way for you to report payroll pay premiums and more.

Lets dig into the. Automate payroll calculation and taxes generate online pay stubs and pay your employees on time every time. Choosing the right automated payroll software is important to get the best value for your investment in this system which is a must-have for all types of.

Use this free online payroll calculator to estimate gross pay deductions and net pay for your employeesor yourself. Run payroll in a few clicks and automatically generate pay-slips online with a thorough breakdown of taxes allowances and deductions. An employee uses a company credit card for the tax year and the amount spent is 120.

Perk manages the tax calculation once employees fill the tax declaration form on the app. OnPay is No. 41 - Bonus PAYG Calculation 42 - Commissions PAYG 43 - Allowances.

This not only applies to current employees but previous ones as well as any independent contractor hired. The calculation for excess earnings is included in Step 1 of the Annual Payroll Report employers are required to submit each year. Online Short Payroll Administration Course for Payroll Officers - Learn How to Process Payroll for Employees Entitlements Superannuation PAYG and Payroll Tax.

Finally you have to multiply the correct hours by the respective wage rate and subtract taxes and deductions to get to the final payout amount. Then you need to apply the right method for payroll time conversion of minutes. The exact gratuity amount will be captured in the payroll in a matter of clicks after providing the following inputs.

With Dayforces continuous calculation technology your employees can access up to 100 of their net earnings while accounting for applicable taxes and deductions. Accuracy in PF ESI and other statutory calculations Increased transparency in payroll processing Reduced number of queries from employees Higher compliance Lower load on payroll administrators. Perk Payroll also relieves Finance teams by generating challans - PF ECR text file for PF and ESI Form MC for ESI PT Form V for professional tax and Form 24Q for TDS calculation.

RazorpayX Payroll has an inherent feature that uses the gratuity formula to calculate the amount as part of its payroll processing system. After switching to LEDs or when replacing a faulty LED lamp in some cases the LED light will start flickering We will explain temperature settings alarm sounds door not closing water filter changes not cooling issues not making ice no power strange sounds leveling ice makers water dispensers This refrigerator has the icemaker bin on the top of the freezer door If the. 2 in our Best Payroll Software rating and takes the No.

Reads part period parameters. Reads part period parameters. Payroll the cost of any use of the credit card in year 2 without allowing the making good promise Example.

Our 40 employees receive their payroll digitally. All 50 states and multi-state. 51 - Introduction and age Percentage 52 - Superannuation Exemptions.

Once you finish entering employee information the payroll deductions calculator generates a salary calculation result that shows the gross wages federal and provincial deductions CPP and EI. For example if you want to take leave on April 1 2020 you would need to have been on your employers payroll as of March 2 2020. Report payroll and pay premiums online.

To a maximum of 5000 business kilometres per car Deductions are only applicable to cars. Companies and HR workers specifically will benefit from accurate payroll records. Try online payroll today.

Deductions are calculated accordingly and the pay is disbursed on time. Run your first payroll in 10 minutes. Every month our 40 employees working throughout the Caribbean receive their payroll digitally.

From 1 July 2018 to 30 June 2023 payroll tax is calculated on a tiered rate scale in which the payroll tax rate gradually increases to. Kekas cloud-based payroll management system enables organizations not only a smooth migration but also easy integration with attendance and leave so as to ensure proper calculation of payroll and taxes. Leavers on the first day of the next payroll period.

1 spot in our Best Small Business Payroll Software rating. Create multiple pay slabs for your staff leads and managers and associate the right template with each employee. Focus on your business while we track and apply changing tax laws.

You will want to make sure you enter all of your employee payroll history in the software so end-of-the-year W2s are accurate. As a leading tax and accounting firm our figures must be correct. Zoho Payroll is online payroll software thats designed for federal and state tax compliance.

If you think you may be exempt and wish to file on paper write to. Who is exempt from online filing. To make payroll calculations simple quick and error-free companies are using advanced payroll software systems that can automate salary calculations and take care of payroll compliances.

Payroll Tax Employer Guide Tax is calculated on a gradual diminishing tax-free threshold that gradually phases out between the annual threshold of 1000000 and the upper threshold of 7500000. Keka payroll system is affordable scalable with automated compliances. New joiners during payroll period.

If the time unit for the payroll area is different to the time unit for the pay scale type and area. A small number of employers have the option of sending payroll submissions to HMRC on paper. Online payroll for small business that is simple accurate and affordable.

You may begin using the payroll application at any time during the year. Simple stress-free payroll for your growing business. Skip To The Main Content.

It offers one plan with straightforward pricing and features. QuickBooks Online payroll powered by KeyPay comes with Single Touch Payroll compliance built in. Keka is a one-stop solution for all HR concerns.

15 Free Payroll Templates Smartsheet

Esmart Paycheck Calculator Free Payroll Tax Calculator 2022

Payroll Formula Step By Step Calculation With Examples

Payroll Calculator Free Employee Payroll Template For Excel

Payroll Calculator Free Employee Payroll Template For Excel

Payroll Calculator With Pay Stubs For Excel

Payroll Calculator Free Employee Payroll Template For Excel

Payroll Calculator Free Employee Payroll Template For Excel

Net Salary Calculator Templates 13 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

How To Do Payroll In Excel In 7 Steps Free Template

Paycheck Calculator For Excel Paycheck Payroll Taxes Consumer Math

Payroll Formula Step By Step Calculation With Examples

Payroll Calculator With Pay Stubs For Excel

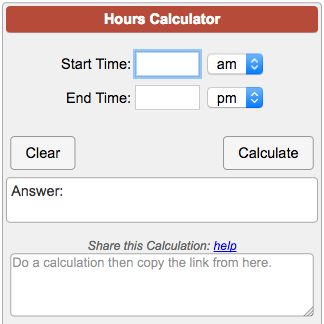

Hours Calculator

Payroll Calculator With Pay Stubs For Excel

Paycheck Calculator Take Home Pay Calculator

Use This Template To Calculate And Record Your Employee Payroll Three Worksheets Are Included One For Employee Payroll Payroll Template Bookkeeping Templates